ive been meaning to look into this dave ramsey thing. i've been pattern trading in the market for a little while now. i ran my numbers last week and i'm at 26% ROI for 2006.

man, i really need to be a little more disciplined about my money!

First 2 quarters and 4th quarter were good this year so I can see that totally.

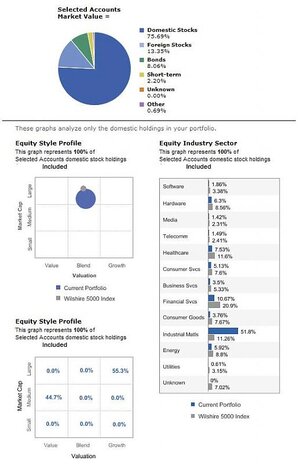

I would check my 401k return for this year to date, but

We're sorry. We cannot process your request at this time. Requests can be processed Monday to Friday 7:00 a.m. to 3:00 a.m., and Saturday 9:00 a.m. to 9:00 p.m. ET. [1002]

What's up with that, it's not like an accountant is sitting there with an abacus.